How to Use Insurance for Effective Risk Management: Insurance plays a pivotal role in effective risk management by providing a financial safety net against unforeseen events that could potentially disrupt an individual’s or an organization’s operations. It works by transferring the risk of loss or damage to an insurer in exchange for regular premium payments.

By leveraging insurance, businesses can safeguard against financial losses resulting from events such as fire, theft, legal liabilities, or employee-related risks. In personal risk management, insurance provides protection against health-related emergencies, life risks, and property loss. It encourages proactive risk management strategies by highlighting potential vulnerabilities and addressing them.

Insurance enables individuals and businesses to plan for uncertainty with confidence, knowing that they are protected from potentially catastrophic financial burdens. It is an essential tool for managing the unpredictable nature of life and business, ensuring long-term stability and growth even in the face of adversity.

Types of Insurance for Effective Risk Management

The main types include health insurance, life insurance, property insurance, and liability insurance. Health insurance helps cover healthcare costs, life insurance ensures financial protection for your family in the event of your passing, property insurance safeguards your assets, and liability insurance shields you from legal claims. Selecting the appropriate type of insurance based on your individual needs is essential for ensuring thorough protection.

Assessing Your Risks: Identifying Insurance Needs

A critical step in insurance planning is assessing risks. Identifying your personal and professional risks—such as potential financial losses, health concerns, property damage, and legal liabilities—will help you determine the appropriate coverage. Once you evaluate your risks, you can clearly identify which insurance policies are necessary to safeguard against these risks, ensuring you have adequate protection.

Choosing the Right Insurance Policy

When selecting an insurance policy, it’s essential to carefully review policy terms, coverage limits, premiums, and exclusions. Each policy offers different conditions, so understanding these details is necessary. Comparing various policies from other insurers will help you select the best option. Additionally, consulting an insurance advisor can provide valuable insights to ensure that the policy you choose suits your needs.

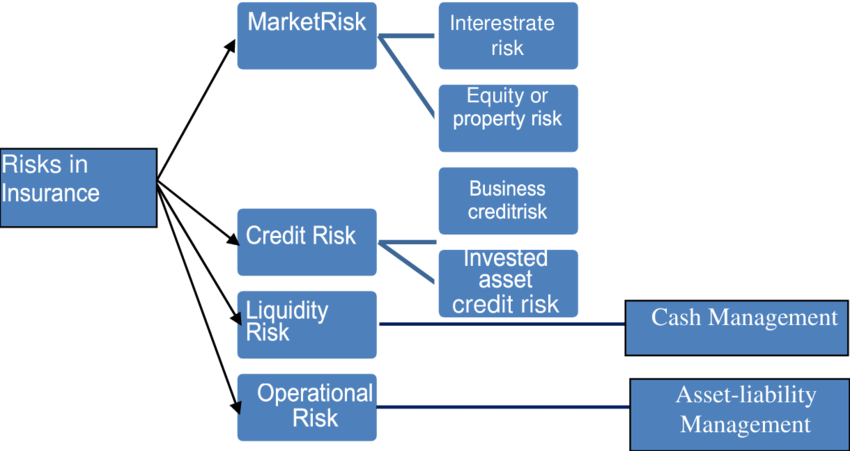

The Role of Insurance in Business Risk Management

Risk management is crucial for businesses as they face various risks, such as operational, financial, and legal liabilities. Business insurance, including professional liability, property, and business interruption insurance, helps protect against these risks. These policies ensure economic stability and continuity, making it essential for businesses to select coverage tailored to their specific risks.

Personal Insurance: A Key Element of Risk Management

Personal insurance is another essential aspect of risk management. Health insurance, life insurance, and auto insurance protect individuals against personal risks, including medical expenses, financial strain in case of death, and damages from accidents. Selecting the right personal insurance policies based on your unique needs is vital for ensuring adequate protection.

Understanding Insurance Premiums and Coverage

To fully benefit from insurance, it’s essential to understand premiums and coverage. Premiums are the amounts you pay to the insurer, while coverage refers to the protection provided by the policy. Insurers determine premiums based on factors like age, health, and risk profile. Knowing the limits of your coverage is crucial to understanding the extent of protection your policy offers.

Read Also: How to File an Insurance Claim 2025

Insurance Claims Process: What to Expect

Understanding how to file an insurance claim is essential. The process involves reporting the claim, providing necessary documentation, and allowing the insurer to assess the situation. Clear communication and transparency are key to a smooth claims process. It’s essential to be aware of your rights and responsibilities to ensure timely and fair claims resolution.

Risk Management Strategies Beyond Insurance

While insurance is vital, there are other risk management strategies you can implement. Preventive measures and contingency plans, such as regular risk assessments and safety protocols, help reduce the likelihood of loss. Combining these strategies with insurance coverage enhances overall risk management, providing a proactive approach to potential threats.

The Future of Insurance and Risk Management

The insurance landscape is evolving with technological advancements. Artificial intelligence and data analytics are transforming the industry, allowing for more personalized policies and streamlined claims processes. As these technologies continue to develop, insurance will become more effective, offering better tools for predicting and managing risks.

Common Misconceptions About Insurance

Several misconceptions about insurance can lead to confusion. One common misunderstanding is that insurance only covers financial losses, not emotional or psychological impacts. Another is the complexity of understanding policy terms and conditions. To address these misconceptions, it’s helpful to consult insurance advisors and access educational resources for more precise insights.

Insurance as Part of Financial Planning

Incorporating insurance into financial planning is key to long-term security. Insurance provides a safety net, ensuring that unexpected events do not derail your financial goals. Your overall financial strategy helps safeguard your future, combining both protection and growth in a comprehensive plan.

Evaluating and Updating Your Insurance Needs

As personal and professional circumstances change, your insurance requirements may also shift. By periodically reassessing and adjusting your policies, you can maintain adequate protection.

Choosing the Right Insurance Provider

Choosing a trustworthy insurance provider is crucial for ensuring timely and efficient service. Factors such as excellent customer service and a high claims settlement ratio should be considered when making your decision. Establishing a long-term relationship with your insurer ensures reliable support and ongoing peace of mind.