How to Lower Your Insurance Premiums Without Sacrificing Coverage: Lowering your insurance premiums can be an effective way to save money while maintaining essential coverage. Several strategies can help lower your premiums without sacrificing protection, whether you’re looking to reduce your auto, home, or health insurance costs.

One common approach is to increase your deductible, which reduces the amount your insurer has to pay in the event of a claim. Bundling policies, such as combining home and auto insurance with the same provider, can also provide discounts. Another strategy is maintaining a good credit score, as insurers often offer lower premiums to those with higher credit ratings.

Shopping around for the best rates and comparing different providers also helps identify cost-effective options. Additionally, some insurers reward loyalty with discounts, so staying with the same provider for multiple years may result in reduced premiums.

Understanding Your Coverage Needs: Focus on the Essentials

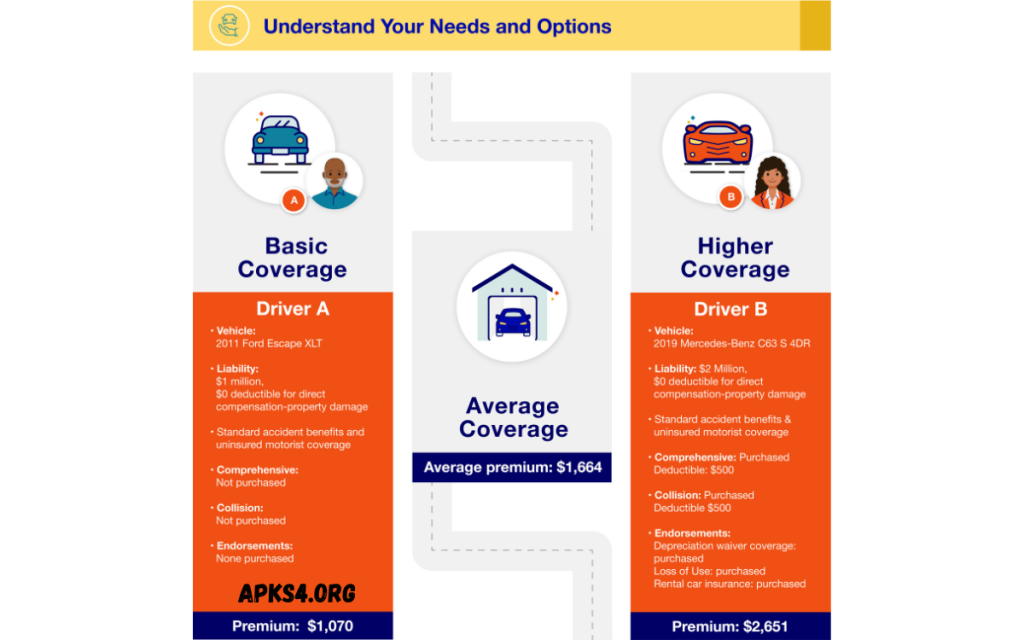

Evaluate your coverage needs. Paying for unnecessary coverage can unnecessarily increase your costs. For instance, if your car insurance includes benefits you never use, it’s time to reassess them. Adequate coverage doesn’t mean having everything but rather ensuring that it matches your specific needs. A great approach is to review your policy every year and adjust it based on any changes in your situation. This annual review allows you to fine-tune your coverage and reduce your monthly or yearly premiums.

Bundle Multiple Policies with One Provider

If you purchase separate car, home, and health insurance policies from different companies, you may be paying more than necessary. Bundling policies, so combining them with a single provider, can save you money. In addition to the discount, you’ll enjoy, which simplifies the process.

Increase Your Deductible to Lower Premiums

Increasing your deductible—the amount you pay out of pocket when making a claim—can help reduce your insurance premiums. While this lowers your monthly premium, remember that a higher deductible means you will need to pay more if you need to file a claim. If you’re financially stable and prepared for potential out-of-pocket costs, this option can save you money in the long run.

Take Advantage of Safe Driver Discounts

For car insurance, a great way to lower premiums is by qualifying for a safe driver discount. Many insurers reward drivers with clean records and no traffic violations with lower rates. Additionally, some companies offer telematics devices that track your driving habits, offering discounts for safe driving.

Install Home Security Systems to Lower Premiums

Fire detectors can significantly reduce your home insurance premiums. These systems lower your insurer’s perceived risk of loss, which can lead to lower premiums. Today’s advanced security features are relatively affordable and provide long-term savings.

Pay Annually to Save on Premiums

While paying your premiums monthly might seem convenient, insurers often offer discounts for paying annually. It can save you 5-10% of your total premium. In addition to saving money, you won’t have to deal with monthly reminders or late fees.

Read Also: The Importance of Health Insurance and How to Choose the Best Plan

Improve Your Credit Score to Lower Premiums

Your insurance premiums. Insurers often offer lower rates to those with better credit scores, as they consider good credit a sign of financial responsibility. If your score is low, work on improving it by making timely payments and managing debt to benefit from lower premiums in the future.

Consider Usage-Based Insurance

Your actual driving habits. Telematics devices track things like speed and mileage so safe drivers can receive discounts. This is an excellent option for those who don’t drive frequently, such as remote workers, as it can lead to reduced premiums.

Group Insurance for Better Rates

Many employers offer group insurance plans that provide substantial discounts. Group policies are typically cheaper because they cover multiple people, and insurers can offer better rates. If your workplace offers this benefit, take advantage of it, as it often allows you to customize coverage to meet your needs.

Bundle Policies for Maximum Savings

If you hold multiple policies, such as auto, home, and life insurance, bundling them with one insurer can lead to substantial savings. Bundling reduces your overall premium costs while simplifying the management of your policies.

Make Use of Available Discounts

Insurance companies frequently offer various discounts, including those for safe driving, home security systems, or multi-policy packages. Staying in touch with your insurer and checking for any new discounts can help you significantly reduce your premiums.

Regularly Review and Update Your Policies

Review and adjust your policy annually. By removing unnecessary coverage and tailoring your policy to current needs, you can lower your premiums. Many insurers allow you to update your policy at no extra cost, making it easy to ensure you’re only paying for what you need.

Reduce Risk Factors

The level of risk you present to the insurer. By reducing risk factors—such as driving safely for car insurance, installing security systems for home insurance, or leading a healthy lifestyle for health insurance—you can lower your premiums. Demonstrating that you’re a low-risk individual helps signal to insurers that you are less likely to make claims.

Evaluate Insurable Assets

It’s crucial to assess your assets and determine which ones truly need insurance coverage. Sometimes, people increase premiums by insuring items that aren’t valuable or necessary. For example, insuring an old car with a low market value might not be worthwhile, and opting for basic liability instead of comprehensive coverage could save you money.

Shop Around for the Best Deal

Before committing to an insurance policy, it’s essential to compare quotes from multiple providers. Different insurers offer varying rates and discounts, and sticking to one provider could mean missing out on better deals. Comparison shopping ensures that you find the best coverage at the most competitive price.

Frequently Asked Questions

Do lifestyle changes affect insurance premiums?

Yes, lifestyle changes such as moving to a safer neighborhood, quitting smoking, or driving less can lower premiums.

What role does shopping around for insurance play in reducing costs?

Comparing quotes from multiple insurers ensures you get the best price for the coverage you need.

Can I lower premiums by reducing unnecessary coverage?

Yes, review your policy to remove outdated or redundant coverage, but avoid cutting essential protections.

Are there discounts for installing safety or security features?

Yes, features like home security systems, fire alarms, or car anti-theft devices often qualify for discounts.

Does paying premiums annually save money?

Paying annually often comes with a discount compared to monthly payments that may include additional fees.

Conclusion

Lowering your insurance premiums without sacrificing coverage is achievable through a combination of strategies. By increasing your deductibles, bundling multiple policies, improving your credit score, and taking advantage of available discounts, you can reduce costs while still maintaining essential coverage.